Labor Unions, Debt, and Financial Advantage in Young Adulthood

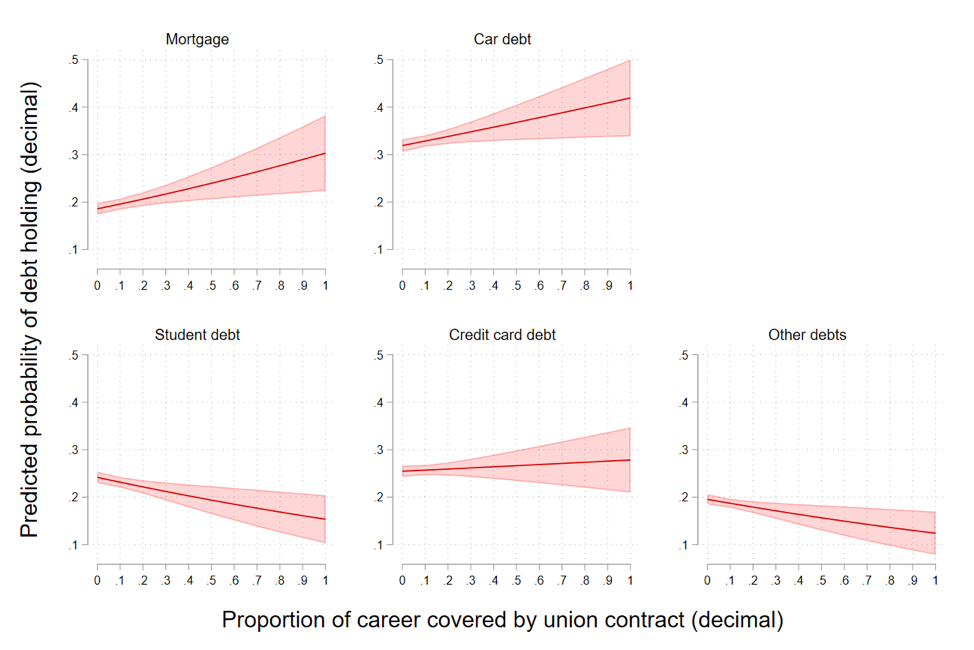

Labor unions reduce labor market inequality by increasing wages, compressing the wage distribution, stabilizing working hours, and offering more comprehensive and generous non-wage benefits. However, less is known about whether and how unions influence workers’ financial advantages beyond the labor market, for example in credit and consumer markets. Using data from a cohort of workers born in the early 1980s who came of age during an historical period characterized by growing inequality, low unionization, and volatile consumer credit markets, Rachel Dwyer and I investigate how early career union coverage influences financial advantage as measured by debt portfolios held around age 30. We find that young workers who were covered by a union for longer durations of their early career were more likely to hold debts tied to asset ownership (e.g., mortgages and car debts) and less likely to hold the costliest consumption and past-due bill debts (e.g., payday loans, medical debt, past-due rent, etc.) by age 30. These patterns were more pronounced for young workers who worked in industries and regions where unions had a stronger presence. Most of the observed associations between unionization and debt holding can be attributed to the labor market payoffs to unionized careers as measured by advantages in cumulative early career earnings from age 18 to age 30. This paper is forthcoming in Work and Occupations.