State Safety Net Policies and Debt

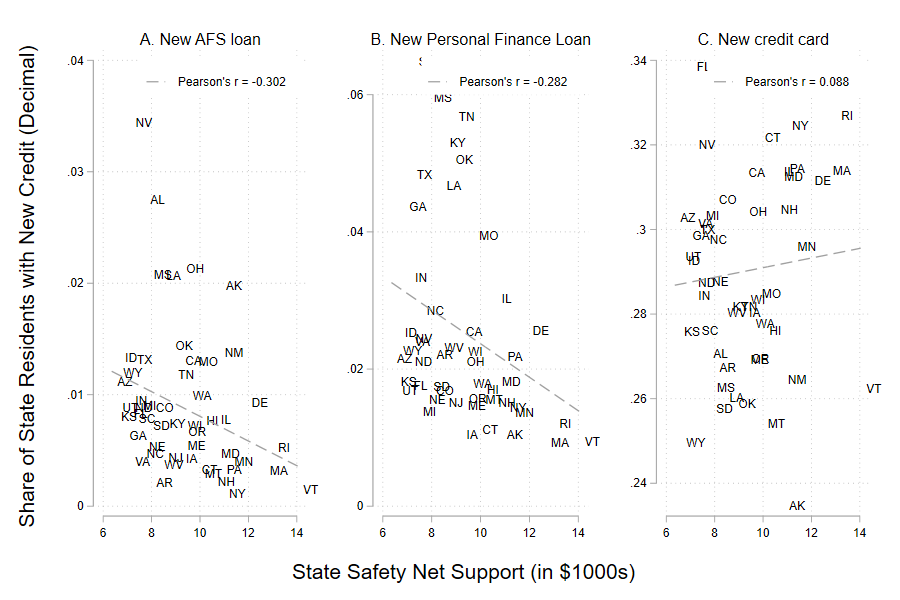

Credit and social safety net benefits are among the most important resources that households rely on when facing income shortfalls and other forms of economic scarcity. Theorists have described a credit-welfare state tradeoff where credit markets become particularly important where safety net benefits are less supportive. In the U.S., the credit-welfare state tradeoff is complicated by stratified credit markets and the decentralized U.S. welfare state, which creates substantial variation in safety net support between states in terms of benefit levels and program accesibility. I am part of an interdisciplinary team of scholars at UW–Madison, Ohio State, the University of Michigan, and Dartmouth College using credit bureau and state administrative data to study the links between state safety net policies and high-cost credit use among low-income populations. Research from this project has been published in Nature Human Behaviour and the American Sociological Review.